The Ultimate Guide to Diversifying Your Portfolio: Trading Stocks, Forex, and Cryptos

Ryan Flores -

Are you looking to diversify your investment portfolio? If so, trading stocks, forex, and cryptocurrencies might be the perfect solution for you. In this comprehensive guide, we will explore the world of trading, discussing the benefits and risks associated with each of these financial instruments. Whether you are a seasoned trader or a beginner looking to dip your toes into the market, this article will provide valuable insights and strategies to help you navigate the exciting realm of stocks, forex, and cryptos. So, buckle up as we uncover the possibilities and potential profits that await those who venture into these dynamic markets.

Benefits of Diversifying Your Portfolio

Diversifying your portfolio by trading stocks, forex, and cryptos can provide numerous advantages. Firstly, diversification helps spread risk by investing in different asset classes. This minimizes the impact of volatility in any one market and helps protect your investments from sudden price fluctuations.

Secondly, trading stocks, forex, and cryptos offers unique opportunities for profit. Each market has its own characteristics and trends, which means that by diversifying, you can tap into a wider range of potential gains. By allocating your capital across different assets, you increase your chances of capturing profitable trades and maximizing your overall returns.

Lastly, diversifying your portfolio can enhance the stability and longevity of your investment strategy. By spreading your investments across multiple markets, you create a more resilient portfolio that can weather unfavorable conditions in any one market. This approach helps you avoid overexposure to specific risks and decreases the likelihood of significant losses.

In conclusion, diversifying your portfolio by trading stocks, forex, and cryptos offers several key benefits: risk reduction, increased profit potential, and a more stable investment strategy. By allocating your resources across different asset classes, you can optimize your chances of success in the dynamic world of trading.

Introduction to Stock Trading

Stock trading is a popular investment strategy that allows individuals to buy and sell shares of publicly traded companies. It offers the opportunity to participate in the ownership and growth of these companies, while also providing the potential for profits through buying low and selling high. Stock trading can be an exciting and lucrative endeavor for those willing to put in the time and effort to research and understand the market.

When trading stocks, it is important to have a basic understanding of how the stock market works. Stocks represent a share of ownership in a company and are bought and sold on stock exchanges, such as the New York Stock Exchange or NASDAQ. Prices of stocks fluctuate based on supply and demand, as well as other factors such as company earnings reports, industry trends, and market sentiment.

The goal of stock trading is to make profitable trades by buying stocks at a lower price and selling them at a higher price. Traders can also make money by earning dividends, which are a portion of a company’s profits distributed to shareholders. However, it’s important to note that stock trading involves risk, and prices can go down as well as up. Therefore, it is essential to carefully research and analyze the companies and industries you are interested in before making investment decisions.

In the next section, we will explore the world of forex trading and how it can be incorporated into your investment portfolio.

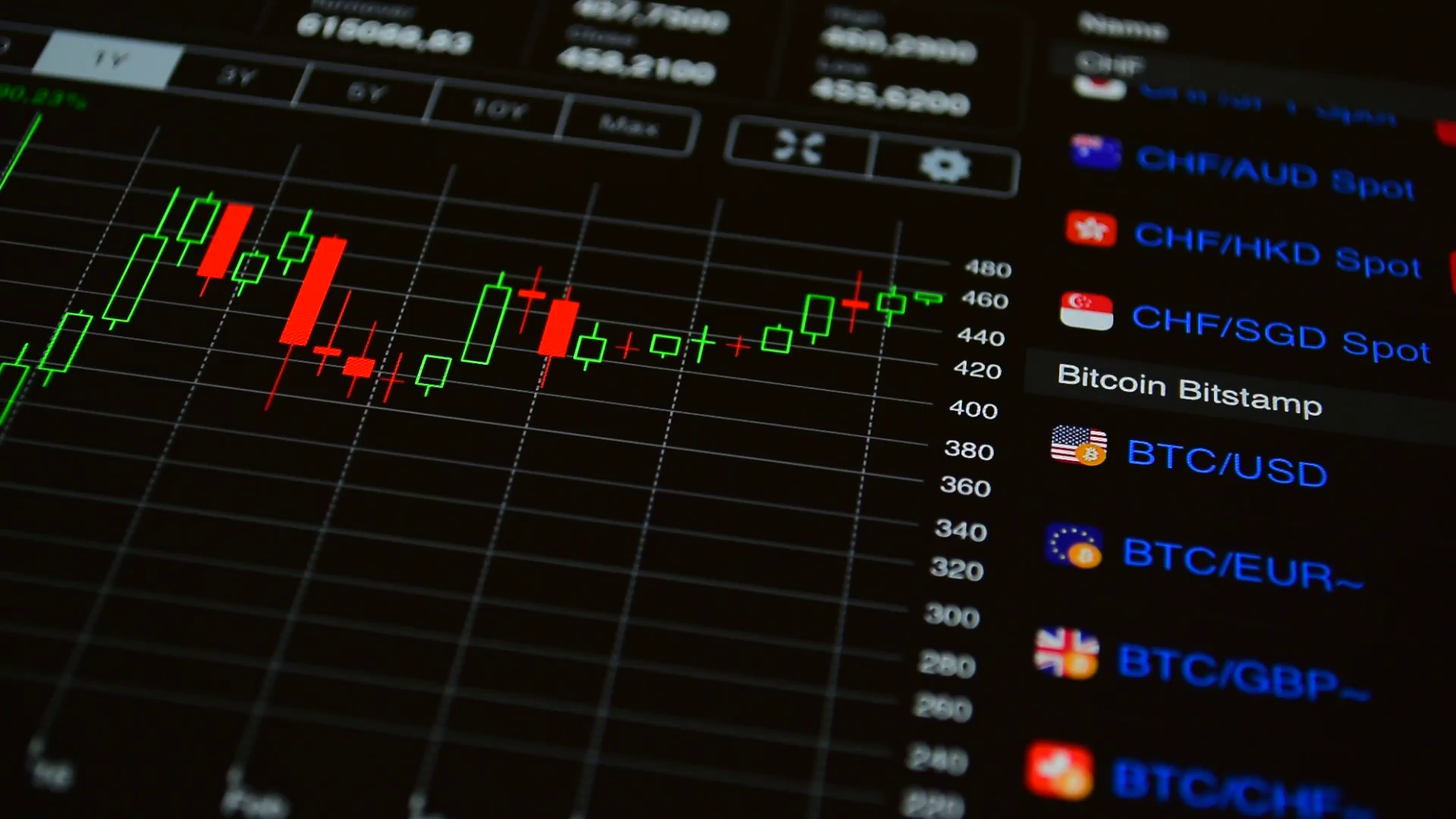

Exploring Forex and Cryptocurrency Trading

In this section, we will delve into the exciting world of Forex and Cryptocurrency trading. These two markets offer unique opportunities for diversifying your portfolio and potentially generating significant returns.

Forex, also known as foreign exchange, involves the trading of different currencies. The Forex market is the largest and most liquid financial market in the world, with trillions of dollars being traded on a daily basis. By participating in Forex trading, you have the opportunity to profit from fluctuations in currency values and take advantage of global economic trends.

Cryptocurrency trading, on the other hand, involves the buying and selling of digital currencies such as Bitcoin, Ethereum, and Litecoin. This market has gained considerable popularity in recent years, offering investors the potential for high returns. With the decentralized nature of cryptocurrencies, trading can take place 24/7, providing ample opportunities for those willing to navigate this dynamic market.

Both Forex and cryptocurrency trading require a solid understanding of market trends, technical analysis, and risk management strategies. It is essential to stay informed about global economic events, central bank policies, and regulatory developments that can impact these markets.

In conclusion, Forex and cryptocurrency trading can be exciting avenues to expand your investment portfolio. However, it is important to approach these markets with caution and seek knowledge to make informed trading decisions. With proper research, risk management, and dedication, you can potentially achieve success in these ever-evolving markets.

You may also like

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | 31 | |||||